Idaho State tax Commission Keywords. Idaho First-Time Homebuyer Programs.

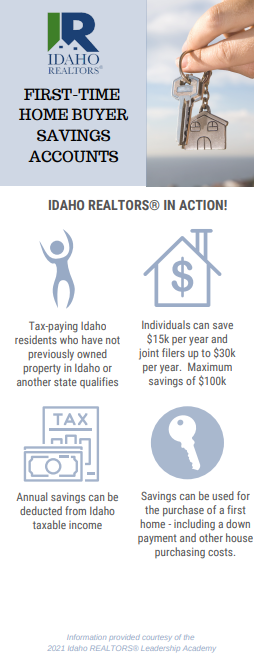

First Time Home Buyer Savings Accounts Idaho Realtors

Married couples filing a joint tax return can deduct up to 30000 yearly.

. In December 2021 the median list price of homes in Nampa was 450000. Real Time Rate Comparison. The Rise Youth and Young Adult Savings account is created specifically for youth ages 0 through 25 years.

In some cases IHFA can also lower. Idaho Central Credit Union offers a variety of products well suited for the first-time homebuyer. Idaho first time home buyers can get 500 to 8000 down payment assistance.

Idaho Housing would provide the additional financing needed. If you used down payment assistance through Idaho Housing you would only need to provide 2000 of your own funds towards the purchase 05 of 400000. Married individuals filing jointly are considered the account holder if they both reside in Idaho if at least one 1 of them has filed an income tax return in Idaho for the most recent taxable year and if at least one 1 of them is a first-time.

Deposits into a first-time home buyer savings account shall not exceed one hundred thousand dollars 100000 for the lifetime of the account. Start typing and press enter to search. Mortgage credit certificate MCC Like many states Idaho offers a mortgage credit certificate MCC to first-time homebuyers that allows you to claim a federal tax credit up to 35 percent of your.

First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA VA and Conventional loans. FIRST-TIME HOME BUYERS Adds to existing law to provide for first-time home buyer savings accounts. Form ID-FTHB Beneficiary and Withdrawal Schedule First-time Home Buyer Savings Account Author.

First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA VA and Conventional loans. Married individuals filing jointly are considered the account holder if they both reside in Idaho if at least one 1 of them has filed an income tax return in Idaho for the most recent taxable year and if at least one 1 of them is a first-time. Ad Americas 1 Online Lender.

Contributions to the account earn interest and may be eligible for a State of Idaho tax deduction. 4 No withdrawals may be made from a first-time home buyer savings account within the first thirty 30 days from the establishment of the account. Ad Grow Your Savings with the Most Competitive Rate.

Idaho First-Time Homebuyer Programs. Nampa first-time home buyers. First-time home buyers can get a conventional home loan with as little as 3 down if the mortgage meets requirements set by Fannie Mae and Freddie Mac.

41 rows The Idaho First-Time Home Buyer Savings helps you save for your first place to call home and is supported by the State of Idaho. Deduction For First-Time Home Buyers allows individuals who open a First-Time Home Buyer Savings Account deductions on their Idaho return equal to their contributions into the account maximum 15000 a year for single filers 30000 for married couples with a lifetime deduction limit of up to 100000. Take the First Step Towards Your Dream Home See If You Qualify.

Individuals can deduct up to 15000 each year. And if you put at least 20 down you won. Idaho State Tax Commission PO Box 36 Boise ID 83722-0410 EFO00326 02-28-2022.

F First-time home buyer savings account means an account established in Idaho with a depository to pay the eligible home costs of the account holder or to reimburse the account holders eligible home costs in connection with a qualified home purchase. Compare Rates Get Your Quote Online Now. Ad First Time Home Buyers.

An Idaho First-Time Home Buyer Savings Account allows you to save for down payment and closing costs if you qualify for a first-time home purchase while reducing the. We specialize in First time home buyer programs that help you purchase your first Idaho home. Idaho Housing and Finance Association IHFA offers first-time homebuyer programs with discounted rates as low as 425 on 30-year fixed-rate FHA VA USDA and conventional loans.

Tax deduction allowed for first-time home buyers. Introduced read first time referred to JRA for Printing. If you want to buy a.

Rather than the typical 5 down payment requirement there are options with down payments as low as 0 down if you are eligible. Open Online in Minutes. Young members with this account will earn a special dividend rate until age 26 and account owners who are age 18 and under can learn about saving with the interactive Rise App in CapEd eBanking.

Please note that all programs listed on this website may. Idaho Code section 63-3022V. 05 is the minimum contribution of your own funds you would need to provide.

Deposits into a first-time home buyer savings account shall not exceed one hundred thousand dollars 100000 for the lifetime of the account. Rise Youth and Young Adult Savings Account. Compare Open an Account Online Today.

Some homebuyers elect to contribute more than the minimum. We also have several loan options with down payment assistance. First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income.

Check Your Eligibility for a Low Down Payment FHA Loan. In fact most of your low to zero down payment options do not require you to even.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Hb 589 Idaho S First Time Home Buyer Savings Account Youtube

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

0 comments

Post a Comment